The Best Guide To International Debt Collection

Wiki Article

Some Of Business Debt Collection

Table of ContentsAll About Debt Collection AgencySee This Report on Dental Debt CollectionThe Of Personal Debt CollectionThe Only Guide to Private Schools Debt CollectionThe Of Private Schools Debt Collection

The catch is that ought to the collector settle for much less than the invoice quantity, the firm's charge does not lower. As an instance, allow's state you bargain 25 percent of each billing will be maintained by the collection firm. If you have a billing for $1,000, the firm's cost would certainly be $250.

This is the most hands-off method yet additionally requires that the financial obligation collection agency take on the most run the risk of. When a collection firm acquisitions your debts, they pay you a portion of the superior billings.

Employing a debt collector might assist you recover lost revenue from uncollectable bills. Business have to be mindful when hiring a financial obligation collection company to make certain that they are properly certified, knowledgeable and will represent your firm well - debt collection agency. Debt collection can be expensive, yet the amount you obtain from overdue invoices might deserve it

The Ultimate Guide To Business Debt Collection

Check your contract for a termination stipulation. Otherwise, get in touch with the agency as well as straight work out such a setup. A discontinuation clause can permit you to break the agreement by paying a cost or giving notification within a details time frame. There may be a deadline in the arrangement whereby time you can pass an escape provision if the company hasn't provided.If they do not follow with on key points of the contract, you might be able to damage the arrangement. You can also merely ask the company what their termination charge is.

The debt collection market not just serves an essential function in recouping exceptional financial debts owed to financial institutions as well as service suppliers, but it likewise provides a level of confidence to lending institutions to make debt offered to a broad variety of customers. This includes the bulk of communication and also collection tasks associated with these accounts. The standing of placed accounts within the stemming lender's invoicing or collection systems ought to suggest that the account is closed/placed.

Some Known Facts About Debt Collection Agency.

At this point, the lender can create off the debt as a balance dues property on their balance sheet since the account is not likely to be paid. The financial institution's balance sheet looks better, yet the lender still preserves the capacity to accumulate on an exceptional property. Collection agencies work on part of the stemming lenders and also try to recuperate overdue balances by getting to out to the consumer using mail and telephone.Representatives attempt to obtain customers on the phone to pay setups with them, either as a round figure to deal with the account or with a series of recurring repayments (debt collection agency). Collection companies normally obtain a commission percentage on the amount of cash they successfully collect. This commission can vary by the age, equilibrium, kind and the number of times the account has been formerly functioned, among others

For this factor, later phase collections tend to have a higher payment rate, since less accounts are most likely visit here to pay. The lower line is the lower buck. When a creditor analyzes whether to proceed internal healing attempts versus outsourcing collections to a 3rd party vendor, the creditor has to blog here have a solid grasp of the approximated internet return of each technique as well as compare that versus the expense of paying compensation versus the cost of running a highly specialized, extremely trained group of customer assistance experts.

How International Debt Collection can Save You Time, Stress, and Money.

Discover our suite of remedies for financial institutions and exactly how our 3rd party vendor monitoring can assist you.

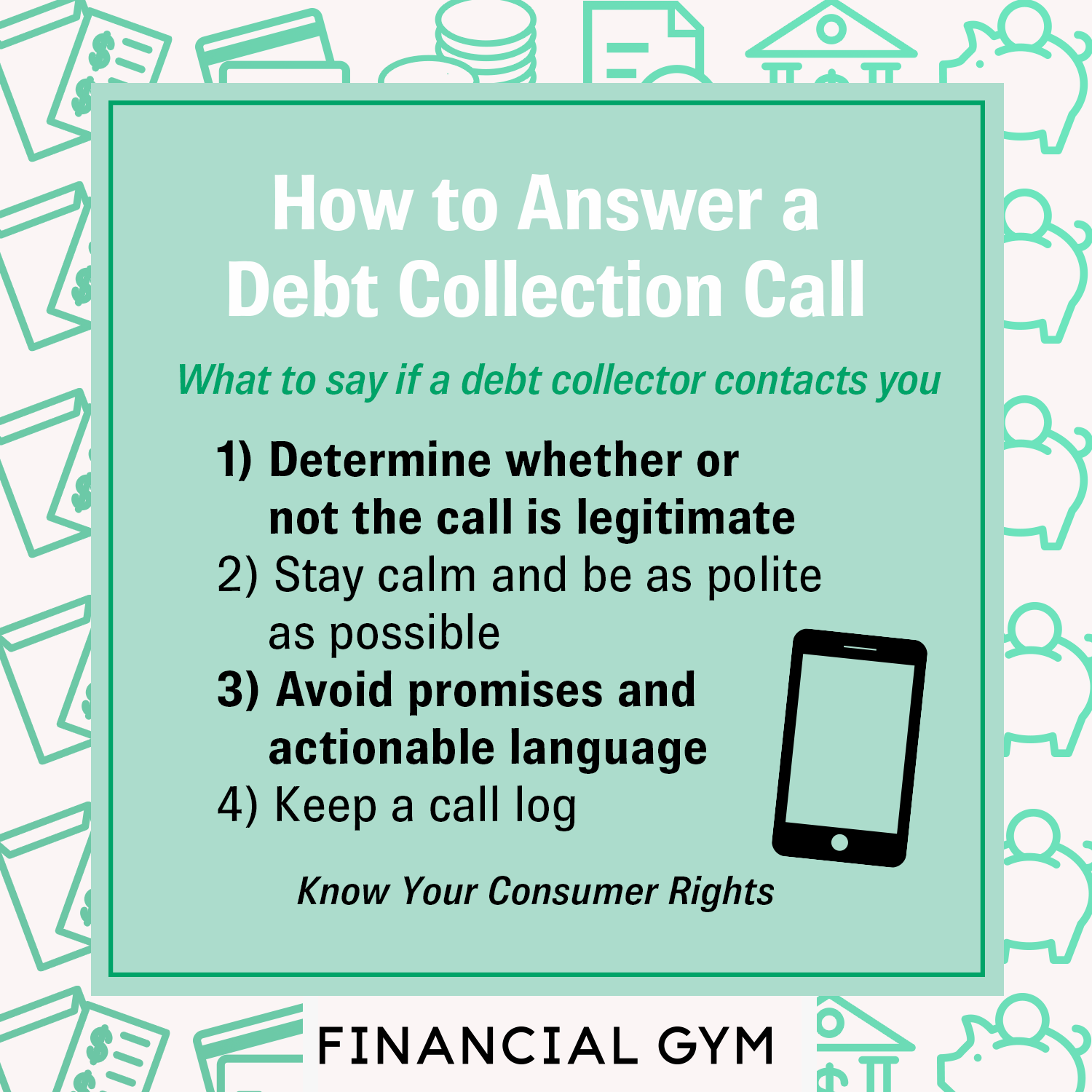

A roommate informs you a financial obligation enthusiast called asking for you. That same debt collection agency has left messages with your family members, at your office, and maintains calling you early in the morning as well as late at night.

The good news is, there are government as well as District of Columbia regulations that protect customers and restrict financial obligation collectors from utilizing specific methods that might be abusive, unreasonable, or misleading to consumers. Under these laws, there are actions that you can take to limit a financial obligation collection agency's contact with you or to find out more concerning the debt collection agency's insurance claim.

Report this wiki page